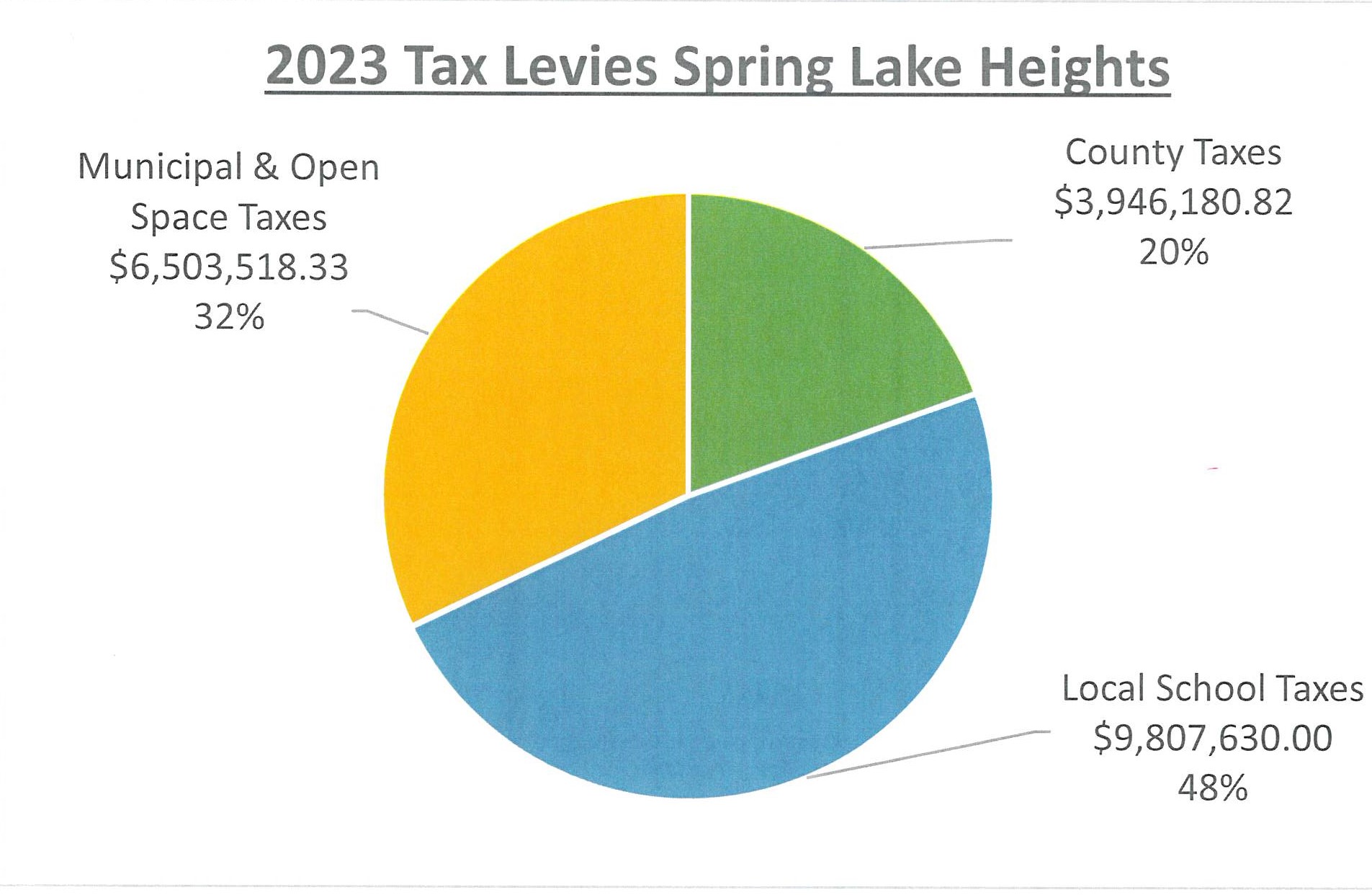

The various tax levies have been certified by the County of Monmouth and the tax bills are now in the mail. The Borough of Spring Lake Heights is the collection point for municipal, school and county taxes. Once collected, the borough remits the taxes collected to the school and county and keeps 32 cents of every dollar collected to operate the municipal government.

The bill that is sent out in July will be the balance of taxes due for the 2023 year and an estimated bill for the first two quarters for 2024. The total of the 2024 estimated bills represents 50% of the 2023 taxes billed each property. The reason for these estimated quarters is that the various agencies have not established their operating budgets in the beginning of the year.

Since the rates were certified a little late, we must give the residents 25 days notice of the August bill according to state law. When there is a delay, we have to extend the grace period. Quarterly payments are due February 1, May 1, August 1, and November 1 and contain a 10 day grace period for payment. The August 2023 grace period has been extended to August 14, 2023.

There is no interest charged during this grace period, but if taxes were paid on August 15th, they would incur an interest charge based upon being 15 days late according to state law.